Even though the Forex market is billed as a 24/5 market, there is such a thing as the best time to trade forex. Just because the Forex market is open does not mean that you should always be trading it.

In this post, we’ll take a look at the main times for trading Forex(and each trading session), and how to determine when the best time to trade forex is for your lifestyle.

Why are Forex trading times important?

The Forex market does not always move significantly. Some hours have a lot of volume, and other hours have a lot less volume.

By volume, I mean price movement. For example, the New York Session tends to have very high volatility, and the Asian session tends to be a little timid.

If you’ve ever placed a trade and saw that price was just stick in a range of a few pips, you may have placed your trade at an off time.

Even though trading activity occurs round the clock, the Foreign Exchange desks at most big banks operate during business hours in their respective countries.

That’s why you need to time your trades with hours where there is a lot of trading volume.

Forex Trading Sessions

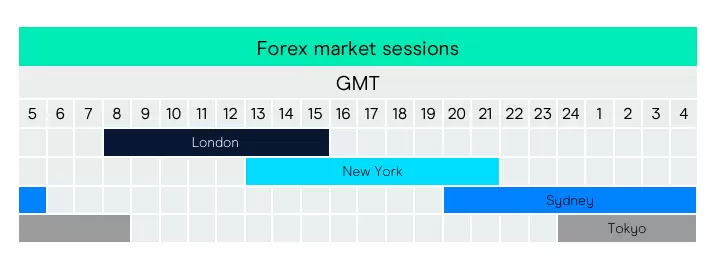

There are three main trading sessions in the Forex market:

- The Asian Session(Sydney and Tokyo)

- The London Session(somtimes called the European Session)

- The New York Session

Each session leads into the next, and one New York Session close to the next New York Session close is typically a trading day. If you’re looking at daily candles on your charts, you’ll want to make sure you’re seeing charts that have New York close candles.

The Asian session

The Asian Session is a combination of the Sydney Session and the Tokyo Session.

During the Asian Session, the Japanese Yen, Australian Dollar, and New Zealand Dollar tend to move the most. By extension, this includes all the pairs.

The London Session

The London Session opens at 8:00 AM GMT time. This is when all the London Exchanges start the bulk of their trading.

The London Session sees movement in nearly all currency pairs(major currency pairs and minors) and metals, and this is when the most volume takes place.

The New York Session

The New York Session starts at 8:00 AM Eastern Standard Time. This is when all the Wall St. banks and trading desks begin their business

Most of the major news releases happen during this time period, which is why the New York Session can have increased volatility.

During high-impact news releases such as Non-Farm Payrolls, it’s not uncommon to see price movements of 50 to 100 pips in a matter of minutes.

Overlapping sessions

The Foreign exchange market hours are structured in such a way that each session leads into the next.

The Asian session starts in Sydney and it leads into the London session. During the Pre-London hours from 6:30 AM GMT onwards, the Asian session is coming to a close and the London session is about to start.

Pre-London and London open tends to have good volatility.

Then there are a few hours of only the London Session, after which Pre-New York starts. The start of the New York Session is early afternoon in London, so that time aligns with when London traders are back from lunch.

Then the London session closes, and the New York session leads back into the Asian session, and the cycle repeats itself.

Different trading sessions have unique characteristics

As you start trading Forex and watching the charts and price action, you’ll be able to see how each trading session causes price to move. While it’s not completely like clockwork(that would be too easy, right?), if you watch the charts for enough time, you’ll start seeing certain patterns repeat themselves.

Since there are so many different currency pairs, it’s difficult to really point out what to look for unless you sit and watch the Forex markets yourself.

The important thing is to choose a few particular currency pairs and observe them regularly at the same time every day to get a feel for how they move.

For example, volume tends to be greater at the start of the London and New York session opens and closes.

Of course, what worked yesterday may not work today, but if you’re regularly watching the charts, you’ll be able to stay on the same page.

If you’re day trading, it’s SUPER important to make sure that you’re watching the charts at the exact same time every day.

Even if you’re swing trading off of the four hour charts, it’s still important to watch the same four hour candle close and the same four hour candle open.

This way, you can really get a feel for the currency pair’s behavior.

Which trading session should you choose?

Which trading session you choose to trade really depends on your lifestyle and your commitments. I would not recommend sitting for more than 3-4 hours at the charts in the course of a whole day.

After all, the point of Forex trading is to free up time for yourself, so if you’re glued to the charts all day chasing after multiple trading sessions, then the purpose is lost!

Also, the more Forex trades you take, the greater your chances become for one of those trades to become a loser and wipe out some of your investment!

The best times to trade are going to be in any of the high volume times, whether that’s Asian open, London open, or New York open. Remember to start about one to one and a half hours before the opening time so you can read the market structure before the volume pours in.

Depending on what particular country you live in, you’ll have to see how your local times align with the Asian, London, and New York sessions and choose your times to trade accordingly.

So if you’re in the United States, working a regular day job and are free in the mornings and evenings, that means you’ll be able to catch the New York session closes and opens. London may be tough because you’ll have to wake up very early!

Alternatively, you can catch the Asian session after you get back from work.

Conclusion

The best time to trade forex is ta time that works for you and aligns with Forex market hours at any one of the three major centers.

The point of Forex trading is to free up time, and that’s the most important thing to keep in mind when you choose your trading session.