OspreyFX is a fairly popular offshore Forex broker that offers lots of trading instruments, low spreads, and institutional grade liquidity.

I’ve had an account with them for over a year and have been very happy on the whole with the experience.

In late 2021, they started offering their own funded trading platform which has terms similar to other popular prop firms like FTMO and My Forex Funds.

In this OspreyFX review, we’ll first take a look at the funded account challenge, then at OspreyFX as a broker, and see whether they’re worth attempting a trading challenge with and signing up with to use as a broker.

OspreyFX Funded account challenge

Up until very recently, OspreyFX only provided retail investor accounts. Since late 2021, they’ve started a funded account for prospective traders.

OspreyFX’s funded accounts are of 3 sizes:

- $20,000 for a $250 challenge fee

- $50,000 for a $400 challenge fee

- $100,000 for a $700 challenge fee

Like most prop firms, OspreyFX’s challenge is two phases.

The first phase is 30 days and you have to hit a profit target of 10% while avoiding a daily drawdown of 5% and a maximum drawdown of 12%.

The second phase is also 30 days and the target is another 10% with the same daily and maximum drawdowns.

In both Phase 1 and Phase 2, there are 10 minimum trading days.

Once you’ve passed stage 2 and obtained your funded account, there is no longer any minimum profit target. You must avoid the same drawdowns as before, and you’re entitled to withdraw profits once a week at a 70-30 split.

How is OspreyFX different from other prop firms?

On the surface, OspreyFX seems quite similar to other prop firms, but there are a few key differences.

For starters, OspreyFX’s second verification stage is just 30 days, and you have to reach a profit target of 10%.

Nearly all other two-step prop firms have 5% profit targets for verification and allow you 60 days to reach that target.

Hitting 10% in the first stage is hard enough, so hitting 10% again is very ambitious indeed, and you’d probably have to take on higher risk than you should to reach the target.

Here’s the HUGE catch that they only talk about in the fine print:

Just because you pass the second stage doesn’t mean you’ll automatically receive a funded trading account.

Instead, upon passing stage 2, a panel of experts will review your trading activity and determine whether you’re a good fit for receiving a funded trading account.

Here are some of the factors they consider:

- You can only make 20-30% of your total profit in a single day. This is to make sure your Forex trading is consistent and you’re not passing just because of one huge winning trade

- They’ll also look at trade sizes to make sure you’re not risking too much money for your account size. This factor is actually quite reasonable and managing risk properly is a sign of a mature trader

- Position sizes in news events: this is to make sure you’re not over-risking and getting lucky on a news event that goes in your direction

- Consistency in position sizes

- How you adjust your stops and limits

Upon completing a review of your Phase 1 and Phase 2 performance, OspreyFX will grant you a trading account.

Additionally, OspreyFX’s challenges are more expensive than most other prop firms out there. If you don’t already have a relationship with OspreyFX and trust them, you may be apprehensive about attempting a trading challenge.

On the flip side, all trading styles are allowed: you can hold trades on the weekend, overnight, use expert advisors, and even signals.

You’re also not limited to just the Forex market. Trading CFDs is possible, and you can also trade certain stocks and cryptos.

Is it possible to get funded with OspreyFX?

OspreyFX is one of the more difficult challenges to pass because you have to achieve 10% in both phases and your Forex trading activity must be approved by OspreyFX’s team before they’ll give you the account.

Compared to other prop firms where it is possible to get funded by luck, your chances of passing OspreyFX’s challenge are much better if you’re an experienced trader with a consistent track record.

OspreyFX as a broker

OspreyFX brands themselves a “lightning fast ECN broker”. Osprey FX aggregates liquidity from over 50 banks to get you very low spreads. Essentially, they pull quotes from multiple banks and liquidity providers and pull the closest bid and ask prices to give you the spread.

In all the time that I’ve used OspreyFX, I have hardly experienced any slippage: my trades are executed nearly instantly.

Trading instruments and spreads

OspreyFX’s true strength among Forex brokers is their amazing lineup of trading instruments and super-tight spreads.

As mentioned above, OspreyFX is able to get these spreads through tieups with leading investment banks all over the world.

So if you prefer trading Forex, CFD trading, metals, cryptos, or even stocks, you can work with a single broker to get exposure to a large variety of assets.

As you’d expect from all Forex brokers, you can trade the Forex Majors, Crosses, and even exotics.

You can also trade all the major global indices, and their crypto lineup is impressive with over 20 different cryptocurrencies you can trade.

Fees and commissions

The Forex spreads you have access to depends on how much money you deposit. OspreyFX has multiple types of pairs: Mini, VAR, Standard, and Pro, and there are ultra tight spreads on the EUR USD pair.

All the Forex Majors and Crosses are available in all varieties.

Standard pairs have medium-sized spreads and a $7 commission for every standard lot($100,000)

Pro pairs have the smallest spreads and a $8 commission for every standard lot($100,000)

VAR pairs have the largest spreads and $0 commission.

Mini pairs have slightly smaller spreads than VAR and $1 commission for every standard lot($100,000).

The actual commission size would be calculated depending on how big your trade was.

For example, if you traded a mini lot($10,000) on a Pro pair, you’d pay $0.70 in commission.

Their crypto spreads are also very competitive: normally, Forex brokers end up charging ridiculous spreads for their crypto products, but Osprey FX is very competitive in this area too.

Trading platforms

OspreyFX offers both the MetaTrader 4 trading platform and the MetaTrader 5 trading platform. Interestingly enough, MetaTrader 5 is not an upgrade from MetaTrader 4. Instead, both are independent trading platforms with slightly different features.

What’s great is that you have full control to choose which trading platform you’ll use. So if you prefer MetaTrader 4 as your trading platform of choice, you can go ahead and use that. If you prefer MetaTrader 5 as your trading platform of choice, you can use that, too.

Also, there’s no limit to how many trading accounts you can have within your OspreyFX account. So you could have one master account, and within that account, you can have multiple trading accounts with multiple platforms and leverage ratios.

For example, you could have:

- One MetaTrader 4 account with 1:200 leverage

- One MetaTrader 5 account with 1:500 leverage to run trading robots on

- One MetaTrader 4 Islamic account with 1:100 leverage to receive trading signals

And so on.

You can also create a demo account from your dashboard to test a new trading system or style, or just to go back to practice on whenever you hit a few losses.

Security and regulation

One of the biggest factors with any Forex broker is whether they are regulated or not. Regulation ensures that customers’ funds are well-protected in case of any issues.

OspreyFX is headquartered in Saint Vincent and Grenadines, where there are no local laws as such that regulate financial service providers such as brokers.

Essentially, OspreyFX is an unregulated broker and if you trade large balances with them, you are taking on high risk: higher than you would take with a regulated broker in a country where laws are stricter.

On the other hand, there are some good security features built-in to the broker’s system such as two factor authentication that prevents anyone from potentially gaining access to your funds, even if they manage to hack your password.

Opening an account

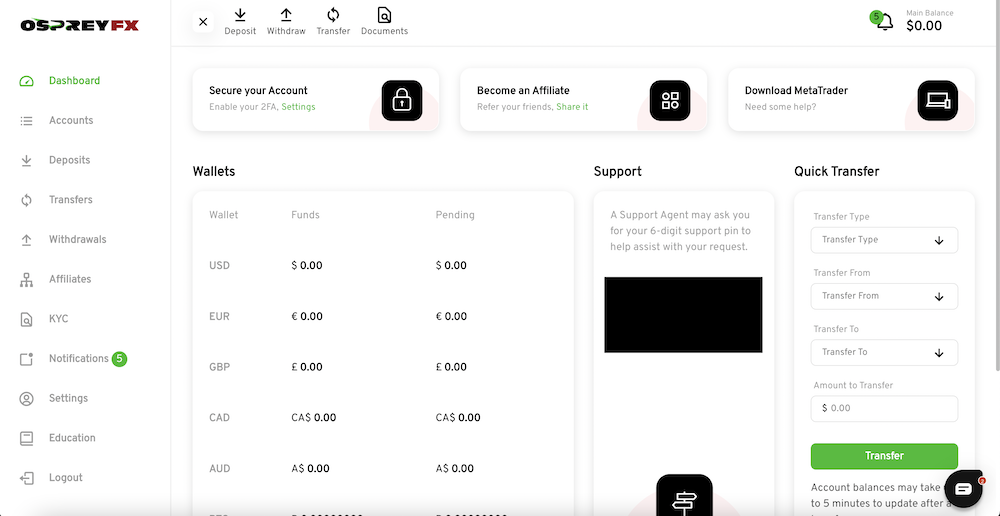

No OspreyFX review would be complete without taking you through the sign up process and dashboard. Signing up for an account is fairly easy: once you have a basic username and password set up, you’ll have to go through a KYC process before you can deposit funds.

Once your KYC has been accepted, there are a few ways that you can deposit funds to start trading.

OspreyFX prefers crypto deposits, so it’s really easy to just send some Bitcoin, Ethereum, Litecoin, Dogecoin, Ripple, or Tether. It’s not possible to do bank transfer, though you can use Instacoins to buy Bitcoin using debit cards and send it right away.

Litecoin and Dogecoin are both fast and have minimal fees, so those are good options to choose when depositing funds.

Once funds are deposited, they go to your main account wallet. From there, you can create as many MetaTrader accounts as you like and deposit money from your main wallet to your MetaTrader account.

Whenever you create a MetaTrader account, you’ll receive an email with login credentials.

Educational materials

OspreyFX has a Forex trading education section on their website which they’ve split into three categories: beginner, intermediate, and advanced.

Each section contains a series of articles about the financial markets and how to trade Forex.

The beginner section has very general information about how the Forex market works, what are trends, and how to use MetaTrader 4.

The intermediate section contains articles about topics such as margin trading, technical analysis, and basic candlestick patterns.

The advanced section just had 2 articles as of this writing. One was about incorporating fundamental analysis into your trading and the other was about advanced risk management strategies.

The educational materials provided by OspreyFX are OK at best. They’re not mind-blowingly helpful, and you can find better resources on YouTube and other websites(including this one!).

Customer support

The OspreyFX website has a live chat box which starts with an AI bot, but quickly connects you to the customer support team when needed.

On the whole, we found OspreyFX to have responsive customer support and they were able to help sort out any issues and questions we had in the span of a few hours.

Frequently Asked Questions

Does OspreyFX offer Islamic Accounts?

OspreyFX does offer Islamic accounts. When creating a new MetaTrader account from within your dashboard, choose an Islamic account.

Is OspreyFX regulated?

OspreyFX is not regulated as they are based in Saint Vincent and Grenadines.

Can you trade stocks with OspreyFX?

You can trade leading US stocks such as AAPL, TSLA, and more with OspreyFX. You can also trade indices like US30 and S&P500.

What is an ECN broker?

An ECN broker is a broker that uses Electronic Communications Networks. This enables the broker to have very fast execution and very tight spreads.

Conclusion

OspreyFX is a very fast and easy-to-use Forex broker that has a wide variety of trading instruments.

The minimum deposit is very less, so novice traders can start trading even if they don’t have that much capital to spare.

However, OspreyFX is an offshore broker, which means there is little to no regulation, and in the event of something catastrophic, there is a significant risk to your capital.

If you don’t mind the extra risk for the extra leverage and instruments and have a plan for withdrawing your funds regularly, it’s definitely worth signing up for OspreyFX.