Lot sizes are an important part of forex trading. The right lot size can help you make more money, while the wrong lot size can lead to heavy losses.

In this article, we’ll discuss some of the factors you need to consider when choosing a lot size. We’ll also look at some tips for finding the best lot size for your trading account.

What’s the best lot size for $1000?

With a $1000 account, you will typically place a trade with a lot size of between 0.05 to 0.1. This equals to $0.50 to $1.00 per pip. 0.05 lots is 5 micro lots, and 0.1 lots is one mini lot.

The lot sizes given above are averages and can change depending on your trading setup and risk tolerance.

You typically want to risk 1-3% of your trading capital in every trade, so your lot size will actually be calculated by your stop loss.

1% of $1,000 is $10, so if you were to place a trade with a 10 pip stop loss, you could use a lot size of 0.1.

2% of $1,000 is $20, so if you were to place a trade with a 10 pip stop loss, you could use a lot size of 0.2.

3% of $1,000 is $30, so if you were to place a trade with a 10 pip stop loss, you could use a lot size of 0.3.

How to choose lot sizes

When it comes to forex trading, there is no one-size-fits-all answer when it comes to lot sizes. The right lot size for you will depend on a number of factors, including your account size, risk tolerance, and trading strategy.

However, there are some general guidelines that can help you choose the best lot size for your trading.

If you are new to forex trading, or if you want to trade Forex but have a small account, it is usually best to trade mini lots or micro lots. These lot sizes will allow you to keep your risk low, while still giving you the opportunity to get your feet wet and make some profits.

Once you have more experience and a larger account, you may want to consider trading standard lots.

It is also important to consider your risk appetite when choosing the recommended lot size in Forex. If you are a risk-averse trader, you may want to trade smaller lots. On the other hand, if you are willing to take on more risk, you may want to trade larger lots.

What is position size in the Forex market?

In the Forex market, position size is the number of lots you take on a trade. A lot is a standard unit of measurement in the Forex market.

There are three different types of lot sizes: micro lots, mini lots, and standard lots.

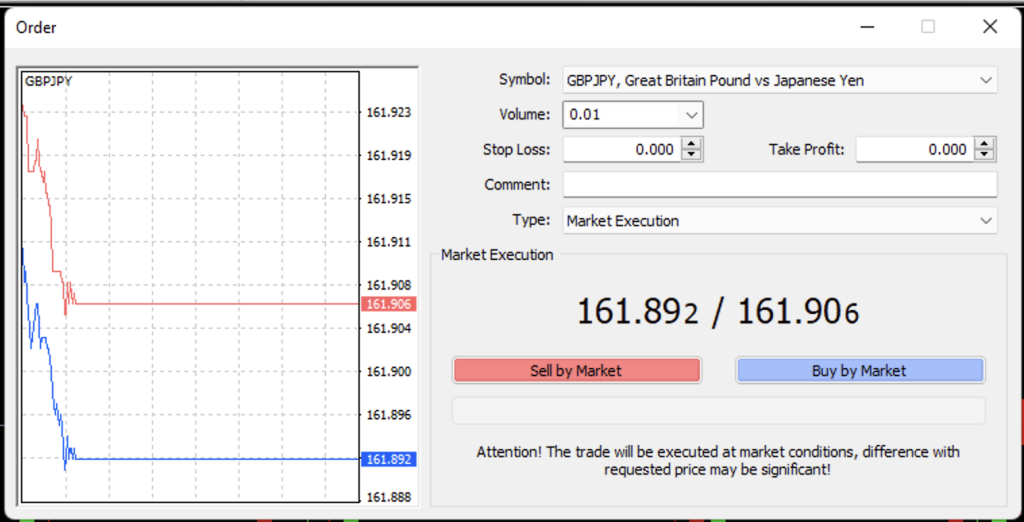

Micro lots are the smallest available lot size. They are worth 1/100th of a standard lot (0.01).

Mini lots are worth 1/10th of a standard lot (0.1).

Standard lots are the largest available lot size. They are worth 1 full unit of currency (1.0).

Does the currency pair make a difference in how much a pip would be equal?

Yes! If the pair you are trading is a dollar based pair, one pip on a standard lot will be equal to $10.

If the pair you are trading is not a dollar based pair, then the base currency will be converted to the US dollar to get you your exact pip value.

What lot sizes to professional Forex traders use?

It really depends on the account size, but I’ve seen some Forex traders regularly place 100 lot trades.

What account size is a good starting point for Forex trading?

If you’re starting out in Forex trading, it’s best to have an account size of a couple of hundred dollars and trade micro-lots until you understand the ins and outs of trading Forex. Once you become a more proficient Forex trader(and on your way to making a living from trading), you can invest more money and start trading bigger lot sizes.

More:

Conclusion

It is important to choose the right lot size for your trading strategy, account size, and risk appetite. Our guidelines should help you start thinking about how you can select a lot size that works best for your needs.

Remember: NEVER risk more than 1-3% of your account on a single trade. It’s always better to live to trade another day than to lose it all trying to become a millionaire overnight.