Note: As of December 2022, The Prop Trading Has CEASED OPERATIONS.

It seems that the prop firm business is booming, and a new prop trading firm is popping up on every corner.

A newer prop firm out of Australia is The Prop Trading. In this The Prop Trading review, we’ll take a look at this prop firm and see who they are, what they offer, and how they stack up against other competing prop firms.

Funding Options With The Prop Trading

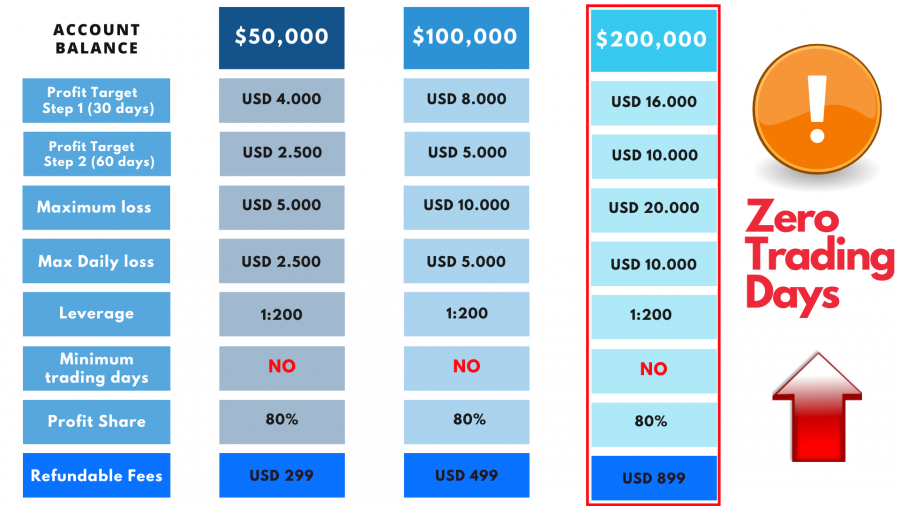

The Prop Trading offer some pretty standard funded account options: $50,000, $100,000, and $200,000.

You’ll notice that this is quite similar to offerings from other prop firms like FTMO and My Forex Funds.

In all three tiers, the trading rules are the same.

You must pass a 2-step evaluation to get your funded trading account.

In the first step, you have to reach an 8% profit target. In the second step, you have to reach 5%. There is a generous 10% drawdown limit, and there are no minimum trading days. This means you can hypothetically get funded in as little as two days.

As far as we know, The Prop Trading offers the quickest way to a funded account aside from purchasing one outright.

Once you’re funded, you’ll receive a refund of your challenge fee with your first withdrawal.

The trading rules are quite relaxed: there are a lot of trading instruments you can trade, you can hold positions overnight and over the weekend, and aside from reaching the profit target and avoiding the drawdown, there are no additional trading requirements.

There is a strange max lot exposure rule once you get your funded account. Basically, you can only open a maximum of a certain lot size for the first three months.

The table is available on their FAQs if you’re interested in checking it out.

Here’s an example:

On a 50k account, the most you can trade is 2.5 lots per instrument. If you trade more than that, you’ve violated the rules and risk losing your account.

That doesn’t mean you can only trade 2.5 lots at a time: you can simultaneously trade 2.5 lots of EUR/USD, 2.5 lots of GBP/USD, and 2.5 lots of EUR/JPY without any issues. You just can’t cross 2.5 lots on a single instrument.

Once you’ve been funded for three months, you can request a review of your account and The Prop Trading will review your account to possibly remove this limitation.

Using EAs and Copy Trading

EAs are allowed if they’re your own, meaning you’ve developed them and coded them.

If you use a commercial EA, it’s very likely that someone else using the same EA will place a trade on the same instrument, and that will violate their rules, since two exact same trades can’t be placed by multiple prop trading accounts.

Copy trading is allowed if you’re copying from your own account to an evaluation account or to a funded prop trading account.

This is kind of a weird rule, especially since it’s not entirely unlikely that you and some other trader out there will place the same trade!

The Prop Trading offers MT5 and no other trading platforms. If you love MT4 as your trading platform of choice, this may be a slightly negative aspect for you.

How are The Prop Trading different from other prop firms?

The Prop Trading sets itself apart from other prop firms by their zero minimum trading days and comparatively easier profit targets.

At a first glance, it seems easier for profitable traders to get funded accounts with this prop firm.

The profit target of 8% is actually much easier on your trading psychology than a 10% target is.

Once you’re funded, there is a generous 80% profit share.

Max exposure rule

However, some of the other rules – especially the max lot exposure rule – is kind of a buzzkill for certain types of trading strategies.

For example, my trading strategy is to risk 1-2% per trade and I usually place my stop losses below the lows or above the highs of the previous 30 minute candle.

In some trades, this low is not too many pips away, so I can take a much bigger lot size for more potential gains.

However, if my max lot size is capped at 2.5 lots, I will usually end up not being able to fully utilize the risk I have planned per trade.

This also destroys the point of their advertised high leverage. The Prop Trading is one of the few prop firms to offer 1:200 leverage, but if you’re unable to take trades larger than 2.5 lots on a $50k account, you’re effectively only trading with 1:5 leverage!

The only way to utilize your leverage is by opening multiple positions across multiple trading instruments, and that just exposes your account to a lot of unnecessary risk.

Related: Are prop firms scams?

Can you actually get funded?

The Prop Trading has indeed funded many traders and their reviews do show that they’ve paid out many traders their profit share.

If you’re a professional trader, you should easily be able to pass the trading challenge. Really, no matter what challenge you opt for, consistent traders are funded traders.

The moment you start taking on unnecessary high risk and have wildly outlandish levels as your profit target, you’ll start to slip.

As long as you stick to your trading plan and follow the rules to the letter, you should be able to hit the profit target and earn your account.

The Prop Trading’s Scaling Plan

Frustratingly enough, The Prop Trading gives very little information about their scaling plan. Compared to other prop firms who have very detailed tables on how their accounts scale up, this is a bit of a shortcoming.

All that we can really glean from what little information is provided is that your account will scale up by 25% for every 4 months in profit, but aside from that, there’s not much information available.

There’s also an option to pass multiple challenges of varying account sizes and combining them all into a single $500k account.

Risks of trading with a newer firm

The Prop Trading is a comparatively newer prop firm and does not yet have the reputation that other more established prop firms like FTMO have.

However, there’s nothing stopping them from eventually getting there.

Early adopters of a prop firm always run the risk of the trading firm not paying out on time, suddenly disappearing without a trace, and poor customer support.

However, from what we have seen so far, The Prop Trading is doing well in its first year and traders are being paid out.

I had taken a challenge with them when they first started, but I was unable to pass it back then.

I will update this article when I eventually pass a challenge with them and report on how efficient their payouts are.

How to diversify your risk

The best way to diversify your risk with any prop firm is to never put all of your eggs in a single basket. Once you’re successfully trading with one prop firm, start and pass a challenge with another one.

This way, you’re diversified and receiving payouts from multiple channels instead of depending on a single company for your income.

If your target is to have a $500k account, consider having one $200k account with The Prop Trading, one $200k account and one $100k with other prop firms.

FTMO and My Forex Funds both allow copy trading, so you can definitely use those two in conjunction with The Prop Trading.

Ways the Prop Trading can improve

More trading platforms

Even though MetaTrader 5 is around, a lot of traders still prefer using MetaTrader 4! The Prop Trading only has MetaTrader 5 with the broker that they use.

Some prop firms actually give you a choice between using MetaTrader 4, 5, or cTrader.

Removing the max lot rule

On paper, the max lot rule is a way to keep your risk down on a live account, but it’s also a way to keep your account equity down.

Some Forex pairs like the EUR/USD move very slowly, so trading the max lots reduces your profit potential.

You’ll also have to scale down your trading strategy from the evaluation to the live account.

Better spreads

The broker that these guys use has very high spreads on some Forex pairs. For example, one of my favorite pairs to trade is the GBP/JPY.

The broker used by The Prop Trading has spreads of nearly 2 pips on this pair, compared to My Forex Funds’ broker who have a spread of less than 1 pip.

If you plan on trading crypto, the spreads are nearly impossible: BTC/USD had a spread of nearly $120.

Clearer trading rules

A lot of the negative reviews left by other traders for this company were related to unspoken rules that ended up closing out some accounts.

One such rule is that they don’t allow you to trade oil, even though it’s available within MetaTrader.

It’s also not clearly stated anywhere on the sales page or the welcome email that certain instruments are not allowed!

Conclusion

With no minimum trading days and a generous profit share, The Prop Trading is poised to knock many other proprietary trading firms off of their top spot.

Just improving a couple of their rules – or making them clearer – will make The Prop Trading a very enticing choice to profitable traders.