In the very noisy world of funded trader programs, few new entrants make as much of a splash as Surge Trader.

Based in the United States and backed by a regulated broker and venture capitalists, Surge Trader is a very unique prop firm that offers very competitive and aggressive accounts that are appealing to both seasoned forex traders and newer traders.

About Surge Trader

Surge Trader is a newer prop firm founded in June 2021. It is backed by Valo Holdings, a VC firm based in Naples, Florida. Interestingly enough, there was not much to find out about Valo Holdings aside from a thinly designed website.

This is kind of an orange flag, but considering that Surge Trader is also backed by EightCap brokers, that strengthens the case again.

Pros

- 1-step evaluation

- No minimum trading days

- Aggressive scaling

- Up to $1,000,000 capital

- Simple rules

Cons

- Low leverage and maximum lot size

- No weekend positions

- Slightly lower 75% profit split that does not increase

The Surge Trader Audition

Surge Trader calls their evaluation program an audition. The idea is very similar to other prop firms you may have worked with in the past: you have to avoid a certain level of loss and gain a certain level of profit to win a funded account.

What’s interesting about Surge Trader is that you can use any trading strategy and there are very straightforward trading rules.

Account Sizes

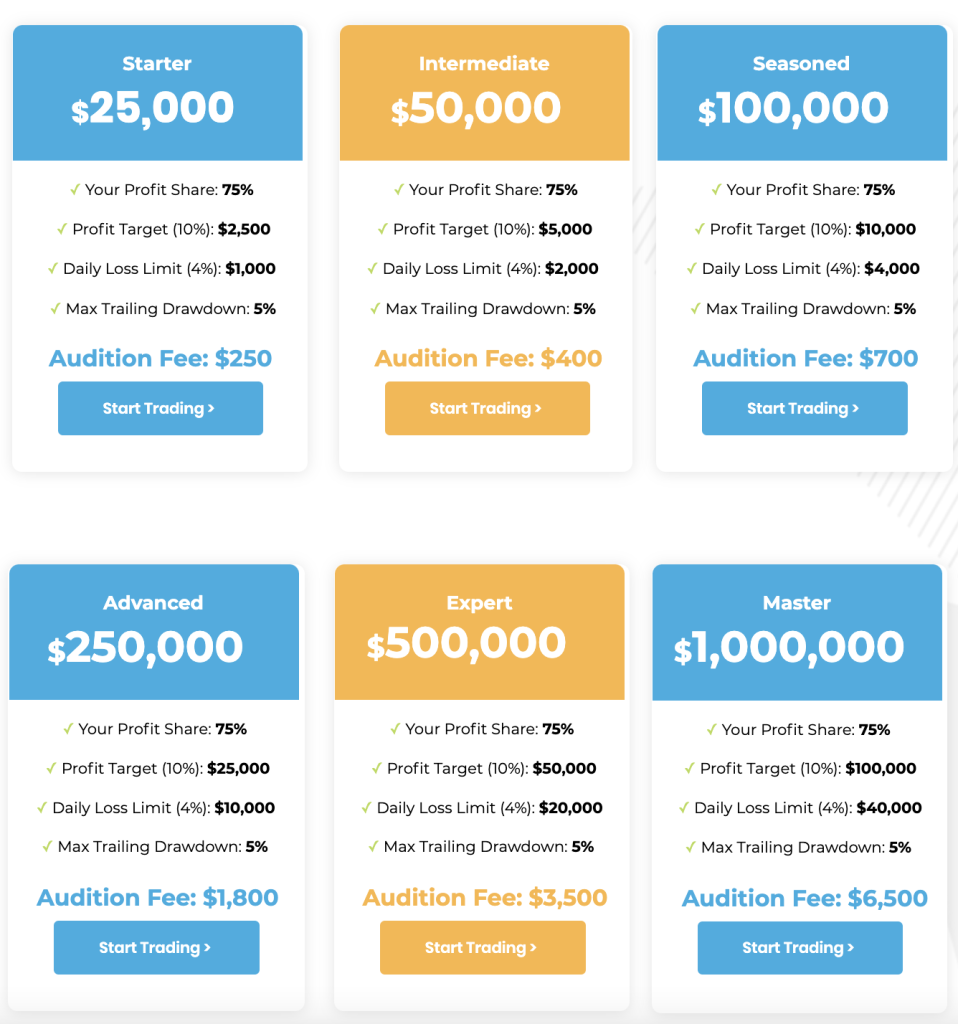

Surge Trader offers the following account sizes:

- $25,000 for $250

- $50,000 for $400

- $100,000 for $700

- $250,000 for $1,800

- $500,000 for $3,500

- $1,000,000 for $6,500

As you can see, these guys really go overboard with the account sizes! They’re one of the few funded trader programs that offer a funded account up to $1,000,000 from the get-go. Other firms that have such large accounts are Fidelcrest and Ment Funding.

The philosophy behind having such large accounts is helping profitable traders capitalize on access to significant funding.

The pricing is also quite competitive. While it’s slightly more expensive than firms like My Forex Funds and The Funded Trader Program, the pricing is about the same as Fidelcrest and FTMO.

Fidelcrest offers $250,000, $500,000, and $1,000,000 accounts for much cheaper. In addition, Fidelcrest essentially gives you a second challenge for free.

The main difference is that Fidelcrest has a 30-day trading period, whereas there’s no maximum day limit for Surge Trader.

To win the funded account, you must hit a profit target of 10%. While a 10% profit target is quite a lot, you have unlimited time to hit it.

This is a big departure from the profit target that other prop firms set in which you typically have 30 days to hit it.

Trading Rules

Surge Trader has really easy trading rules for a prop firm. There is no restriction on trading strategies and you can even copy trade from your own account to Surge Trader. However, you can’t copy trade between Surge Trader accounts.

The first and most important rule is the drawdown. You can drawdown a maximum of 4% in a single day, and there is a 5% trailing drawdown.

As you can see, there’s not much of a difference between the maximum daily loss and the maximum trailing drawdown. This is important at the start of your trading journey, because if you go in the red right away, you’ll have very little room to work with.

Once you cross 5% on your account, the drawdown is reset to your starting balance. From this point on, you can grow your account as much as you want and you won’t lose your account unless you dip below your starting balance.

Another rule you must follow is that every trade needs to be opened with a stop loss.

So if you are a scalper that trades quickly then sets stop losses, you’ll have to adjust your trading style to have a stop at the time your trade is placed.

You can do this easily through MetaTrader itself, as well as with trade management EAs like Magic Keys.

The next rule is that trades must be closed for the weekend by 4PM EST on Fridays. Since you’re trading live funds, you can’t hold over the weekend as there may be significant price movement over the weekend which can put you in a large loss.

Finally, the last rule is kind of a bummer: you can only open a maximum position 1/10,000 of your account size in standard lots with open risk.

If this sounds confusing, it IS.

Basically, what this means is that the maximum number of standard lots you can open at any one time is your account size divided by 10,000.

So if you have a $50,000 account, your maximum lot size is $50,000/10,000 or 5.

Now the open risk part means you can only open 5 lots that have some risk on the table. Once you eliminate risk from those 5 lots, you can now open another 5 lots.

Here’s an example of how that could work:

Let’s say you open 5 lots on the AUD/USD and your trade starts to go into profit. You move your stop loss to 1 pip above breakeven, so you’ve effectively eliminated risk on this position.

Now you can open another 5 lots if you want to.

However, you’ll never end up opening the full 5 lots because you only have 1:10 leverage, so opening 5 lots would instantly result in a margin call because of the spread.

I find this quite inconvenient because I often take trades larger than 5 lots. Even though the trade is larger than 5 lots, my risk is always 1 to 1.5%.

So if I wanted to trade with these guys, I would have to reduce my risk quite significantly on some positions to stay within the position size requirement. This would also result in me reaching the profit target even slower.

While the position size limit is certainly a little restricting, the scaling plan kind of balances it out.

Scaling Plan

Surge Trader offers a talented trader a really good opportunity to accelerate trader funding. If you have the trading skills necessary, you can very quickly scale up from $50,000 to $500,000.

Here’s how that works.

When you pass the first profit target of 10% on accounts between $25,000 to $250,000, you are presented with two options:

You can either receive a live account OR you can choose to hit another 10% to double your account size.

Starting at $50,000, you’d need to make 10% to pass the first target.

If you can make another 10%, you’ve secured a $100,00 account.

If you can make another 10%, you’ve secured a $250,000 account.

If you can make another 10%, you’ve secured a $500,000 account.

That means you can jump from a $50,000 account to a $500,000 account in just 4 10% increments.

There’s a HUGE caveat here that you need to be aware of. If you choose to scale up, you can’t be paid until you secure a live account. If and when you hit the profit target, you’ll need to decide if you wish to continue risking OR secure your account.

By contrast, if you were to work with Fidelcrest, you’d need to make 10% twice anyway to receive a funded trader account. However, Fidelcrest does pay you for passing the Phase II evaluation.

Profit Split

Surge Trader offers a flat 75% profit split on all account sizes. As of now, there’s no option to increase your profit split percentage.

What sets Surge Trader apart from other proprietary trading firms

So should you skip the likes of FTMO and My Forex Funds and instead go with Surge Trader?

VC backing

Surge Trader is a newer proprietary trading firm so they are filling that gap with backing from a Venture Capital firm. This is a good plus point and few other prop firms out there have this kind of backing.

Working with a regulated broker

Unlike many prop firms that are established in countries that have less strict financial regulations, Surge Trader is based in Florida and works with EightCap, an ASIC regulated broker. That means there’s strong backing from both the prop firm side and the broker side.

It also means you have a LIVE account with REAL money.

That actually makes Surge Trader’s formula quite interesting.

Consider this:

The audition fee for a $50,000 account is $400. Once you pass, the company is risking $2,100 on you.

In case you fail and lose the account, the company needs 4 more signups just to offset your loss.

If you’ve read my post about how prop firms make money, you’ll see the ridiculously large number of traders who fail challenges.

One-step audition

Most prop firms will have you pass two stages of evaluation before handing over the keys to a funded account.

Surge Trader only asks for a single 10% gain before they’ll give you a funded account.

Aggressive scaling

Scaling is an important part of growing your income and really compounding your gains. With Surge Trader, you can hypothetically grow from $50,000 to $500,000 in the span of a few weeks.

Not that you should trade so aggressively, but if you can catch a few big moves, you can scale up very quickly.

Very few rules

Surge Trader lets you trade with any trading style or trading strategies. You can use algorithmic trading, copy trading from your own account, swing trading, day trading, or whatever works for you.

Deep retake discount

If for some reason you fail the audition, you can retake it for a 20% discount. This is quite a departure from the typical 10% discount offered by My Forex Funds.

Reviews

Surge Trader is a verified company on TrustPilot and has an average rating of 4.4 stars with 64 reviews as of this writing.

Good reviews talk about the relaxed rules, customer service, and funded accounts.

Some of the bad reviews reflected the fact that their trailing drawdown rule seemed a little unfair.

To compare, FTMO has 4.9 stars from nearly 3,000 reviews. To be fair, FTMO has been around since 2015.

Surge Trader Review: Conclusion

Is Surge Trader all a talented trader is looking for? Perhaps.

Here’s what they have going for them:

- A wide variety of trading instruments from Forex, Metals, Indices, and Crypto

- Working with an ASIC regulated broker

- Ability to rapidly scale trading account

- Competitive challenge fees

- Very few trading rules

If you can get around the slightly lower profit split and lower leverage, you can get a massive funded trading account with Surge Trader and start playing in the big leagues.