Unlike other Forex pairs, the pip value on gold is a little bit different in the way it shows up in MetaTrader 4 and 5. In this post, we’ll take a look at how to count pips on gold.

Knowing how to count pips on gold is essential to formulating a proper trading plan and knowing what to expect as your trade progresses!

To read pips on gold, it’s useful to look at the tens decimal place in the value per ounce. If the current value of XAUUSD is 1856.00 and you see price move to 1856.50, that’s a movement of 5 standard pips or 50 micro pips.

Counting Pips On Gold On MetaTrader 4 and 5

You can count pips in all gold charts on XAU/USD by looking at the tens decimal point. The ones decimal point is a micro-pip.

A price movement of one dollar in Gold is equal to 10 pips, and a movement of 10 dollars is equal to 100 pips.

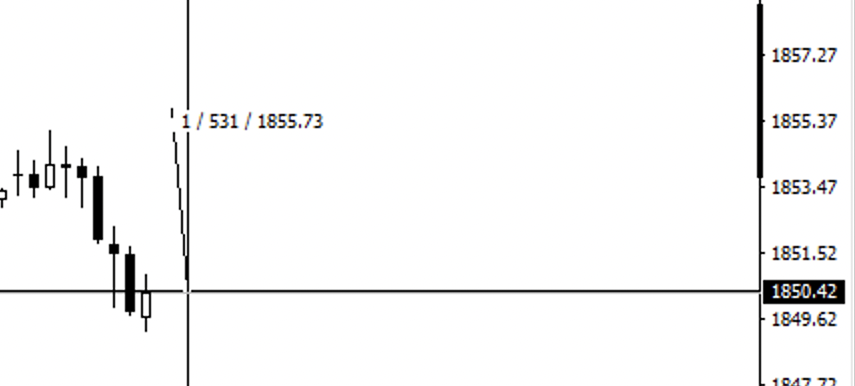

Using the crosshairs tool, click on any point in the chart and drag a line to another point. The value in the middle is the number of pips.

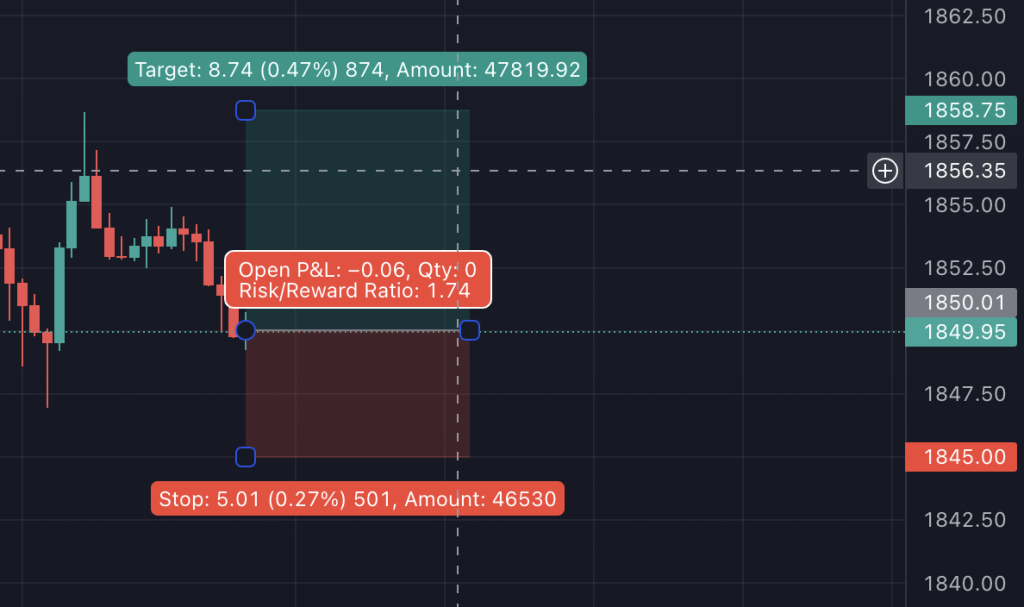

You’ll find something similar in TradingView.

When you drag the trade planner and set the stop loss to $5, it will show that the stop loss as 500 gold pips.

On another currency pair, this would be 50.0 pips.

Remember to be very cautious when you place a trade on XAUUSD. If you’re not careful about lot sizes, you can very easily blow your account by setting a stoploss that’s too big!

How do gold pips and lot sizes work?

Unlike Forex trading, where one standard lot is $100,000, a standard lot when you trade gold is 100 ounces of gold.

That’s why gold pips are $0.10 in Gold price movement per pip. A $0.10 move times 100 lots equals $10, or the pip value of a standard lot on other USD currency pairs.

Similarly, a mini lot would have a pip value of $1 per pip, and a micro lot would have a pip value of $0.10 per pip.

If you were to trade gold with one standard lot(100 unites), expecting that the price moves $1, you’d make 10 pips or $100.

Interestingly enough, it’s actually easier to calculate gold pips than it is to calculate pips for some cross currency pairs.

In a gold trade, the pip value is always a multiple of ten, much like a USD currency pair such as the EUR/USD.

To be on the safe side, use an online pip value calculator like the one by MyFXBook and BabyPips or a risk calculating EA like MagicKeys.

The Benefits Of Trading Gold along with Forex

Gold traders will usually swear by XAUUSD! Even if you usually trade Forex, gold trading can be very lucrative.

One of the main advantages of buying and selling gold on the Forex market is that you can take advantage of the high volatility to get quick and sometimes huge wins.

While a pair like the EUR/USD usually moves 60-70 pips per day, it’s not uncommon for XAUUSD to have a pip movement of over 100 to 150 pips in a single day.

With the right trading strategy, these huge swings make it easier for you as a Forex trader to grab your pips.

Easier to analyze

The XAUUSD price is driven largely by the strength and weakness of the dollar. A weaker US dollar generally means more dollars are required to buy gold, and a stronger dollar means that less dollars can buy the same amount of gold!

Additionally, when the markets are scared, the price of gold tends to go up, whereas when the markets are booming, the price of gold tends to fall.

That’s because gold is a safe-haven, so money flows in to gold from riskier assets during market uncertainty, and from gold to riskier assets during economic growth.

That’s because gold is a precious metal, and a precious metal is a value store.

Gold trading is not a walk in the park: finding your entries is still challenging, and you have to be careful with the volatility. Sometimes, gold can wick up or down very nastily before going in your original direction.

Lots of liquidity

Gold has the highest trading volume compared to other currency pairs on the Foreign exchange market. This means there are so many more people watching the gold market and trading it.

This results in strong moves in either direction and very little slippage.

If your trading plan is to grow your trading account by scalping 10-15 pips every single day, gold is one of the best pairs to do it on. Gold can move 10 pips in just a couple of minutes.

Once you find your entry, you can take your 10-15 pips and be on your merry way!

Watch out for the spread

Because gold is a slightly exotic pair on most Forex trading accounts, you need to be mindful of the spread. So when you count pips to your stop loss and take profit, remember to keep the spread in mind.

Note: the spread is the different between the bid price and the ask price.

Most brokers have quite competitive spreads, but they will differ from one broker to the next. If you plan to start trading gold very regularly, remember to find a broker that offers a spread that you can work with.

I have worked with a few brokers and have seen that spreads on the lower side tend to be about 1.5 to 2 pips, and even 3-4 pips on the higher side.

If your plan in trading gold is to just grab 10 pips, a 3 pip spread will greatly change your trading plan.

Frequently asked questions

Do all brokers have a gold trading account?

Not all brokers offer gold trading. Most US Forex brokers don’t offer trading metals, so it’s best to check the pairs offered by the broker before you sign up with an account.

How to trade gold in the US?

The US government’s financial controls don’t allow US-based Forex brokers to offer gold. So if you want to work with a US broker and still trade gold, you’ll need to trade it through exchange traded funds like the CME.

Conclusion

When trading gold, remember that the tens decimal place is one standard pip, and the ones decimal place is a micro pip.

- A gold pip is worth $10 if you trade a standard lot contract size of 100 XAUUSD.

- It is worth $1 if you trade a mini lot of 10 XAUUSD.

- It is worth $0.10 if you trade a micro lot of 1 XAUUSD.

Finally, your trading plan should depend on your investment objectives and your risk appetite. Don’t trade a position value greater than what you’ve specified in your risk management rules.

After that, just treat gold as any other price chart and use your technical analysis and fundamental analysis to capitalize on price movements!