If you’ve ever held a trade overnight, you’ll probably have come across something called swap, where an amount of money is either credited or debited from your trading account.

What is swap, and how do you avoid it in Forex trading? That’s exactly what we’ll cover in this article.

3 ways to avoid swap in Forex trading

- Close all positions before the end of your broker’s trading day

- Trade with a broker that offers a swap-free Islamic Account

- Trade instruments that don’t have swap(stocks, metals, crypto)

What are swap fees?

Swap fees arise because of a difference in interest rates between the two currencies that you are trading.

When you place a trade, you’re holding an amount of a certain currency. Because you don’t have cash and you’re holding it in an “account”, you would receive interest on your holdings just as you would if you had placed the amount in a savings account.

This only happens if you hold a position overnight – there’s no interest involved if you close the position before the trading day ends.

However, even though you’re holding one currency, you’ve also sold another, so you’ll have to pay interest on the other currency.

The swap that you end up incurring is the difference between the two interest rates.

If the currency you bought has a higher interest rate than the currency you sold, you’d receive a small amount as swap.

If the currency you sold has a higher interest rate than the currency you bought, you’d have to pay a small amount as swap.

Interest rates are pretty low worldwide as of this writing so swap fees won’t be much either way, but they can still add up over a long period of time.

Swap is only incurred when there are currencies involved, so if you place trades in other instruments, you don’t have to pay or receive a swap.

FXStreet has a handy page where you can refer to real-time updated interest rates of the major central banks of the world.

You can use this data to calculate whether you’ll receive or pay swap on your trade.

The formula for calculating swap is a little complex:

Contract value x (base currency interest rate – quote currency interest rate) / 365 days x current base currency rate = swapHere’s a hypothetical:

For example, say you bought 1 standard lot($100,000) of NZD/USD at 0.6200.

The interest rate of New Zealand is currently 3.00, and the US interest rate is 2.5.

Plugging in the numbers, you’d get:

$100,000 x (3.00% – 2.5%) / 365 X 0.62 = $0.84

How do you get a swap free account?

Many brokers offer swap free accounts where you can hold positions overnight and not be charged/receive any interest.

These accounts were introduced for Muslim traders for whom interest-bearing transactions are forbidden(or haram).

You can also find these accounts labeled as Islamic Swap-Free accounts.

The best thing about these kinds of accounts is that there is no extra fee to sign up for one where available, and the brokers don’t care whether you’re Muslim or not.

However, someone does have to eat the swap, and in a swap-free account, that someone is your broker.

They’ll recuperate those fees by charging commissions or slightly higher spreads.

Most reputable brokers offer swap-free Islamic accounts upon request.

If you’re based in the United States, Forex.com offers swap-free accounts.

If you’re looking of an offshore broker, OspreyFX offers swap-free accounts, as does HankoTrade.

OspreyFX and HankoTrade both have very competitive spreads, too, so they’re definitely worth checking out.

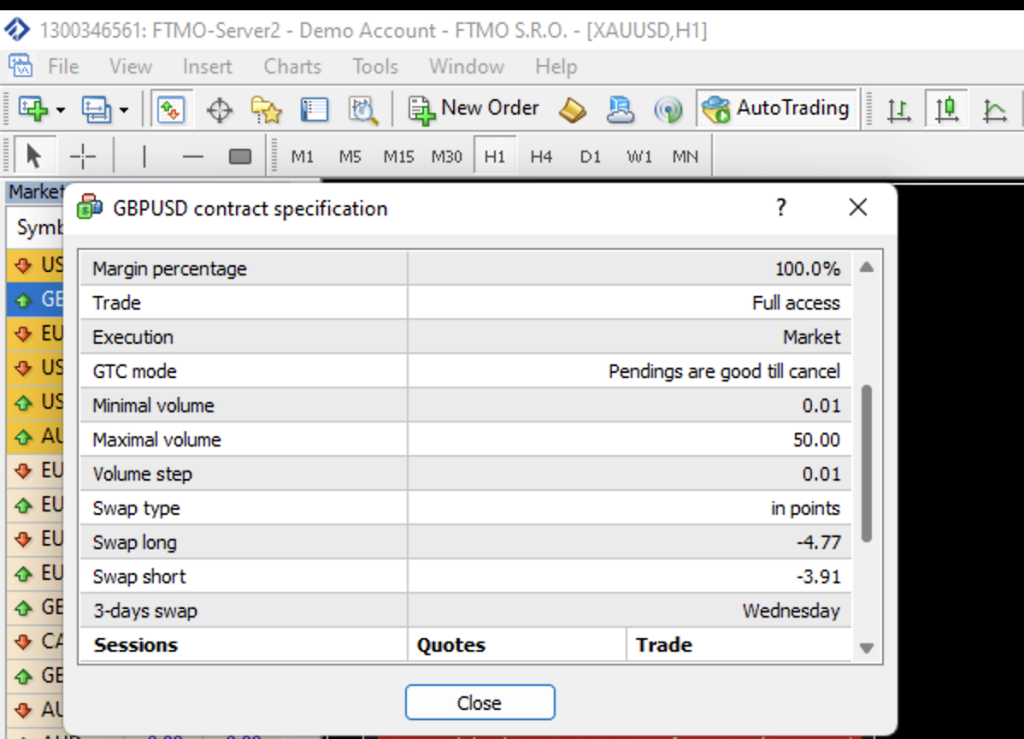

How to see swap in MT4

If you want to see the swap for a pair before placing a trade, it’s fairly easy to do in MT4.

Head to the “Market Watch” tab and find the symbol you’re looking for.

Right-click and select “Specification”

Scroll down and you’ll be able to see the swap if you long or short.

Conclusion

Swap isn’t that much of an amount for most traders, but if you’d like to avoid it in Forex trading, it’s fairly simple to do using the steps we’ve outlined in this article.

Related