Funded Trading Plus is a relatively new prop firm that offers a different take on the typical funded trading model.

One of the key differences between this company and other proprietary trading firms is that Funded Trading Plus provides its funded traders with an actual live account backed by E8 capital.

Pros

- One-step, two-step, and instant funding options

- Successful traders can start trading right away

- Reasonable profit target

- Good profit split

- EAs and copy trading allowed

- Simple rules

Cons

- Low leverage of 1:10 to 1:30

- Withdrawals can affect your drawdown limits and scaling

Funded Trading Plus Funded Accounts

Funded Trading Plus offers 3 types of Forex trading accounts. The Experienced trader program, the Advanced Trader program, and the Master Trader program.

Within each tier, you can choose from a variety of account size options.

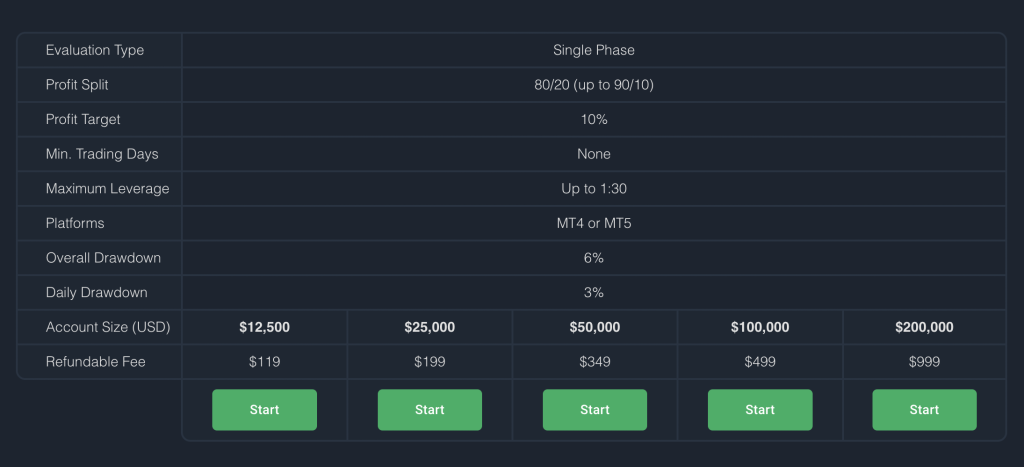

Experienced trader program

The Experienced Trader Program is a one-step evaluation with no maximum or minimum trading days.

You must achieve a profit target of 10% and avoid a maximum drawdown of 6%. Per day, you must avoid a drawdown of 3%.

Once you pass the evaluation, you get access to a funded account and you’re entitled to a profit split of 80/20. Upon showing that you are consistently profitable and can manage risk, you’ll be scaled up in account size and you’ll receive a higher profit split of 90/10.

If you choose to opt for the one-step evaluation, you’ll have 5 trading account sizes to choose from:

- $12,500 for $119

- $25,000 for $199

- $50,000 for $349

- $100,000 for $499

- $200,000 for $999

Advanced trader program

Another form of trading challenge offered by Funded Trading Plus is the Advanced Program.

The Advanced Program is a two-step evaluation process with a more generous daily and overall drawdown.

In Phase I, you must make 10% profit while avoiding a 5% daily drawdown and a 10% overall drawdown.

In Phase II, you must make 5% profit while avoiding the same 5% daily drawdown and 10% overall drawdown.

Once you pass Phase II, you’ll receive a live funded account and you no longer have a profit target.

Like the first program, there are no minimum or maximum trading days.

The available account sizes are as follows:

- $25,000 for $199

- $50,000 for $349

- $100,000 for $499

Master trader program

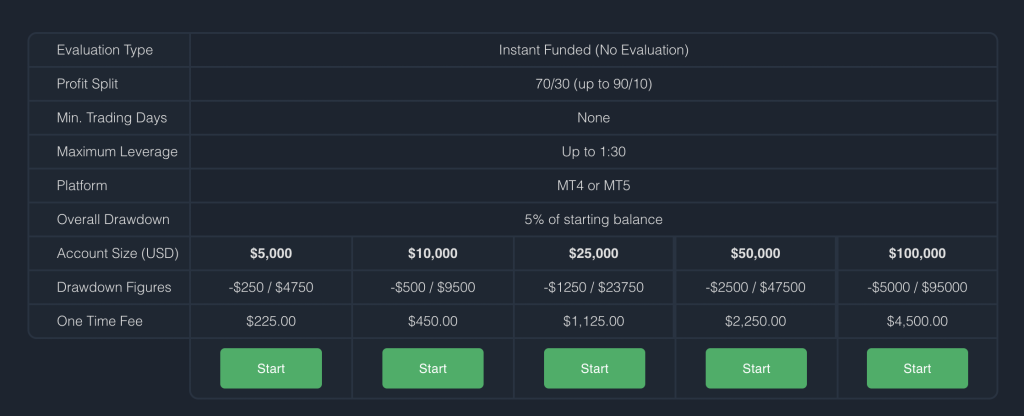

Finally, the Master Trader Program is an instant funding model where you can get immediate access to a live account.

Many prop firms have started to offer retail traders the option to get direct access to a live account.

There are 5 account sizes, and you can trade as you like provided you don’t hit a 5% drawdown, which disqualifies you from the account.

- $5,000 for $225

- $10,000 for $450

- $25,000 for $1,125

- $50,000 for $2,250

- $100,000 for $4,500

Once you hit 5% profits, the drawdown no longer trails and becomes absolute, meaning your starting balance is now the cutoff.

For example, if you grow your $50,000 account from $50,000 to $52,500, your maximum drawdown becomes your initial balance and stays there.

So even if you hit $60,000, you can still draw your account down to $50,000.01 without losing your account.

Not that you’d want to do that, but it does alleviate a lot of the pressure of a tight drawdown!

How the single-phase and two-phase evaluations differ

There are two key differences between the single-phase and two-phase evaluations: the drawdowns and the profit target required to reach the next level of funding.

Your drawdown is 6% total and 3% per day during the single-phase evaluation. You also need to make just 10% to scale up to the next level.

Your drawdown is 10% total and 5% per day for the two-phase evaluation. Here, you need to make 20% to scale up to the next level.

In the two evaluation accounts and the direct funding account, the drawdown becomes the initial balance once you cross a certain percentage threshold.

How Funded Trading Plus is different from other prop firms

Funded Trading Plus is pretty new on the prop firm scene, but their funding models are very unique. What’s more, the prices for the challenges are very competitive.

Trade at your own pace

We’d be remiss in putting up a Funded Trading plus review if we didn’t point out that the biggest advantage of going with this prop firm as opposed to other prop firms is that there are no time limits to achieve the profit target.

The financial markets are very finicky, and there may be multiple days when you don’t find a trade. When you have a deadline to meet, you sometimes try taking bad trades, which can cascade into losing your account.

That’s actually the business model of many a prop firm, and that’s what actually makes funded trading so difficult.

Funded Trading Plus is different because there’s no pressure to hit the target. You can trade very comfortably and at your own pace. This also allows you to risk much less per trade, making each trade less stressful than if you risked more.

This is ideal for swing traders who may not see a setup forming for many weeks.

No complex rules

Many prop firms have lots of complicated trading rules. Funded Trading Plus has just two simple sets of rules: hard rules and soft.

The hard rules will violate your account, and those are the daily and maximum drawdowns.

Soft rules are holding trades over the weekend and opening trades without a stop loss. You won’t lose your account in these cases, but the trades will automatically be closed.

You’re also free to use EAs and even copy trade from your personal account to this account, though you are not allowed to copy trade from a third party.

Lots of instruments

Funded Trading Plus is backed by one of the most reputable Forex brokers in the world: E8 Funding. Through this broker, you can trade a huge variety of instruments from Forex pairs, metals, commodities, indices, and over 100 cryptos.

Great scaling options

Funded Trading Plus has some of the best scaling options in the proprietary trading firm industry.

Every time you hit a 10% gain on your trading account, you can scale up to the next level. The scaling plans are the same for all three types of accounts.

Assuming you start at $12,500, you can reach $2,500,000 in trading capital in just 8 steps.

From $12,500, you’ll be scaled up to $25,000.

From $25,000, you’ll be scaled up to $50,000.

From $50,000, you’ll be scaled up to $100,000.

From $100,000, you’ll be scaled up to $200,000.

From $200,000, you’ll be scaled up to $400,000.

From $400,000, you’ll be scaled up to $800,000.

From $800,000, you’ll be scaled up to $1,600,000.

Finally, from $160,000, you’ll be scaled up to $2,500,000.

Since Funded Trading Plus provides account sizes from $12,500 to $200,000, you’ll start your scaling journey from whichever account size you pass the challenge on.

So from a $200,000 account, you just have to make 10% four times to reach $2,500,000 in funding. This is for the Experienced and Master Trader programs.

Note: If you’re trading the Advanced Trader Program, you’ll need to hit 20% profit each time to scale up.

This is much better even than The 5%ers, who have an impressive scaling plan themselves.

Can you really get funded with Funded Trading Plus?

Past performance is never an indication of future results, but considering the profit targets and the fact that you have until forever to reach the target, you can easily achieve the 10% needed to get to the next level.

The key to successfully completed the assessment phase and indeed maintain your account is to think like a professional trader and employ solid risk management to your trading.

Remember, there’s no rush. So if you can reasonably risk 1% or even %0.5 per trade to make a 1:2 risk:reward, you can make from 1-2% per trade.

That means you only need 5 winning trades in a row to hit your profit target. Even if you don’t see a setup form every day, choosing 5 excellent trades will greatly increase the likelihood of you succeeding than trying to trade on every trading day and losing some trades in the process.

Which trading platforms does Funded Trading Plus support?

Funded Trading Plus supports your favorite trading platform: MetaTrader 4 and MetaTrader 5. Along with those two platforms, they also plan on adding support for TradingView soon.

TrustPilot Reviews

Most of the reviews on Trustpilot.com for this prop firm are quite positive. There are a few complaints from people who did not fully understand the rules and inadvertendly breached them. To be fair, the trailing drawdown rule is a little confusing!

Check them out hereConclusion

To sum up this Funded trading plus review, it seems that this proprietary trading firm is a really good deal. Their programs are very flexible and competitive, and as long as your risk management is good and you think like a professional trader, you can be very confident that you can pass the challenge.