Fidelcrest Overview

- Multiple funding options for beginner and professional traders

- Scale up to $1,000,000

- Good profit splits

- Reputed company that’s been in business since 2018

- Not much trader support

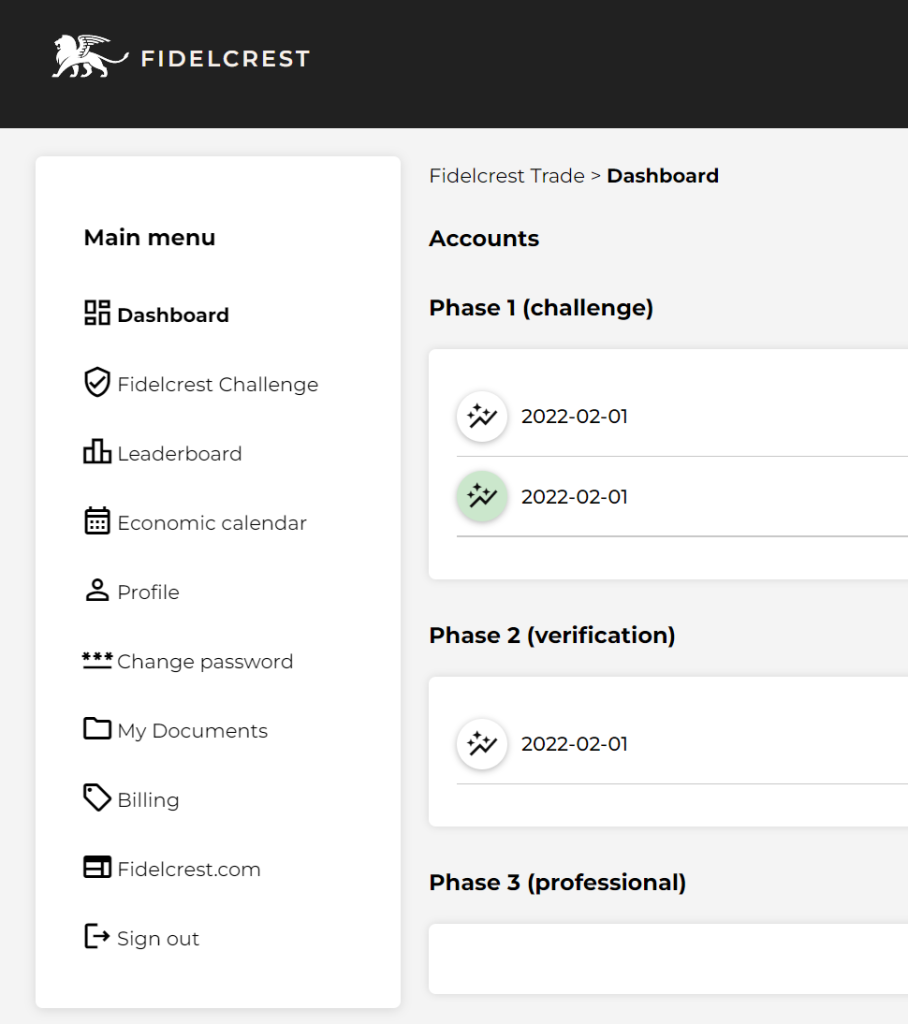

- Good automated dashboard

Out of the many prop trading firms out there, one that sometimes flies under the radar but is actually very competitive in terms of their programs and rules is Fidelcrest.

In this Fidelcrest review, we’ll talk about the different funding options they offer, why they are an appealing option for beginner and professional traders, and whether they’re worth looking into or not.

Fidelcrest Funding Options

Fidelcrest offers two types of accounts to prospective traders: a Micro Trader account and a Professional Trader account.

The Micro accounts are available in $10,000, $25,000, and $50,000.

The Professional Trader accounts are available in $150,000, $250,000, $500,000, and $1,000,000 and use MT4 as the trading platform.

Both accounts can be won by passing a challenge. The challenge rules change a little from Micro to Pro, so let’s take a look.

Fidelcrest Trading Challenge

Like most trading firms, the Fidelcrest Trading Challenge has two phases: an initial trading challenge phase followed by a verification stage.

If you opt for a micro normal account, the profit target in the first stage(3o days) is 5%, followed by another 5% in the verification stage(60 days).

If you opt for a micro aggressive account, the profit target in the first stage(30 days) is 15%, followed by another 15% in the verification stage(60 days).

Next up are the professional account options.

The Professional normal account has a 30 day trading period and a profit target of 10%, followed by another 10% in the verification stage.

Once you receive your funded account, there is no minimum profit target, though there is a minimum trading period of 10 days.

The cool thing is that if you’ve hit your target for the month before 10 days, you can just trade micro lots to count for trading days.

Profit share

In both the Micro and Pro funded account types, you’ll receive an 80% profit split. Aggressive accounts receive a 90% profit split.

This is of course after the funded verification phase, which is meant to test your risk management skills.

How is Fidelcrest Different?

One of the biggest ways that Fidelcrest sets themselves apart from other prop firms out there are the lower profit targets for the verification stage for micro accounts.

For example, Fidelcrest is probably the only firm out there that is willing to give $50,000 in funding capital for just a 5% profit target.

MyForexFunds and The Prop Trading also have lower profit targets of 8%, but that’s not quite as low as 5%!

For many people, a $50,000 account is access to enough capital to live off of, and the decreased stress from just needing to achieve a 5% profit target makes it much more likely that you’ll pass the intial challenge and make it to the verification phase.

What’s special about the verification stage, too, is that it is a funded verification phase. That means you’re entitled to 40% or 50%(depending on if you’re trading normal or aggressive accounts) of the profit you make during the verification itself.

Most other prop firms offer you a refund of your challenge fee with your first withdrawal.

This means you’ll have to complete one challenge, the verification, then remain profitable for at least one period of two weeks or one month before you can get a refund of your fees.

Fidelcrest will pay you more than the challenge fee back when you hit the minimum profit target on the verification itself, which is really cool!

For example, the Micro account for $50,000 in capital costs 449 EUR, which is about $500, give or take a little(we are a Forex site, after all, so we know the rates are going to fluctuate!)

Once you hit the 5% target of $2500 in the verification stage, you’ll receive 40% of that, or $1000. That means you can get back double the amount you invested in just 20 trading days.

The Pro trader and aggressive trader profit targets are much higher, though.

One thing worth mentioning here is that the challenge account costs a little more than it would with other firms.

For the same amount of money ($500), you can take a $100,000 challenge with My Forex Funds, though you’ll have to hit a slightly higher target of 8% instead of 5%.

Also, you’ll have to wait till your first profitable month to get a refund of your trading fees.

Receiving a free second account

When you sign up for an account with the Fidelcrest prop trading firm, you’ll have an option to either receive double your capital or get a free retry.

If you’re confident in your skills as a Forex trader, you can opt for receiving a free second account, and the moment you pass your first challenge, they’ll immediately provide you with a second trading challenge account.

If this is your first challenge and you’re a little unsure of how you’ll perform, you can opt for a free retry and they’ll offer you a free retry if you fail the challenge.

This is actually a huge selling point, because no other prop firm will offer you a free retry even if you fail the challenge!

However, this is also a catch-22, because even an experienced trader can fail the challenge, so if you fail the challenge and you selected double your capital when signing up, you don’t get the account!

Similarly, if you selected “free retry” and you end up passing, you won’t get a second challenge for free.

Fidelcrest Trading Rules

As far as a prop firm is concerned, Fidelcrest accounts have fairly similar trading rules. There is a 10% maximum drawdown on micro accounts and a 5% drawdown on professional accounts. The drawdown limit goes up if you are doing the aggressive trading challenge.

You can trade a wide variety of Forex pairs, indices, metals, and crypto.

News trading is allowed, and you can hold positions overnight, but not over weekends.

You can’t use robots to trade unless the robot has been approved by Fidelcrest’s customer support team.

Copy trading is also not allowed, and if you have multiple challenge accounts, there has to be at least one minute in difference between opening and closing trades between them.

This makes trading multiple accounts a little difficult for day traders and scalpers, though swing traders will not have that much trouble since one minute here or there won’t make too much of a difference.

My style is closer to scalping and I rarely stay in a trade for more than 20-30 minutes, and sometimes one minute can make a huge difference in profits or losses!

How to pass the Fidelcrest trading challenge

Forex traders, especially experienced traders will not have any problem at all passing the Micro trader challenge. 5% is not difficult at all to achieve on a prop firm funded account.

In fact, when I first attempted the Fidelcrest trading challenge, I went into a slight drawdown on the first day, then managed to recover and reach 5% in just 5 more days.

After that, I just had to take micro trades to hit the minimum trading days requirement.

Forex traders who are highly confident of their trading skills and risk management skills can easily take this prop trading firm’s $1,000,000 challenge and receive a life-changing amount of funding within the bare minimum of the required trading period.

Customer Support

Fidelcrest has a live chat box for customer support which is quite responsive and you’re connected with a real human within a few minutes.

These guys are able to answer most queries for you, but if there is a more complicated question, they’ll give you an email address you must contact.

I had to get in touch with the guy on email to get approval for using Magic Keys on my account, and I received a reply after 2 days.

When I emailed the same guy on another occasion, I received a reply within a few hours.

All in all, that seems like quite a reasonable timeframe to get a response in for any company, much less a prop trading platform.

Withdrawals

Withdrawals are pretty straightforward. Once you qualify for a withdrawal, you can head over to your account area and make a withdrawal request. The Fidelcrest team will process it in 1-3 days and send you your money.

You can either choose to receive the money on the same card you paid with, as bitcoin, or as a wire transfer.

Fidelcrest is based in Cyprus, so wire transfers will not be economical if you live outside the SEPA area, as the fees will really eat into your profits.

The best way to withdraw would be bitcoin.

Fidelcrest Review Conclusion: Legit and worth it?

For a prop trading firm, Fidelcrest has really shaken up the markets with their $1,000,000 funded account and $50,000 micro account.

They’ve immediately vaulted ahead of the game in terms of competitiveness.

These two changes will make them much more appealing to forex traders than any other prop trading platform, and even though the trading program fee is a little higher, your chances for success using strict trading rules and realistic trading are much higher, too.

The only thing that remains to be seen is if this new model is sustainable for Fidelcrest: if a lot more people pass the $1,000,000 challenge and the payouts really start scaling up, they need to have the money to pay everyone!

Sign up here