When there’s real money on the line, it’s really easy to let your emotions dictate your trading decisions.

If you’ve ever traded, you’ve probably taken trades based on emotion and regretted it immediately.

The apparent solution to this is automated trading systems that can place and close trades based on mechanical rules and remove all emotions from trading.

It also lets your edge play out over time without letting anything else get in the way.

What is Automated Trading?

Automated trading systems are software programs that utilize an algorithmic trading strategy. The designer of the trading system codes the Forex trading robots to follow certain rules for entering and exiting trades.

If the rule conditions are met, the robot will execute trades, and if the rule conditions are met, the robot will also close the trades.

Automated trading solutions can provide a hands-off trading solution. This can work in your favor, because you’re probably not able to watch the charts all day long. A trading robot can be set up on an automated trading platform or using MetaTrader and a VPS that runs 24/7.

Automated trading in MetaTrader 4 and MetaTrader 5

MetaTrader 4 and MetaTrader 5 are two popular trading platforms that support automated trading.

MetaTrader 4, also known as MT4, is a platform that allows traders to automate their trades using custom-built Expert Advisors (EAs). EAs are programs that are written in the MetaQuotes Language 4 (MQL4) and can be used to execute trades automatically based on a set of rules or conditions.

MT4 also offers a wide range of built-in technical indicators, charting tools, and other features that make it popular among traders.

MetaTrader 5, also known as MT5, is the successor to MT4 and offers a range of new features and improvements over its predecessor.

It also supports automated trading using custom-built EAs and allows traders to use a wider range of order types. MT5 also offers a wider range of built-in technical indicators and charting tools, as well as the ability to trade stocks and futures.

Both platforms offer backtesting capabilities, which allow traders to test their strategies on historical data to evaluate their performance before deploying them in live trading.

Additionally, both platforms offer a wide range of third-party EAs and indicators that traders can use to automate their trades, and also allow traders to test their strategies on historical data before deploying them in live trading.

Automated trading in TradingView

In addition to MetaTrader 4 and MetaTrader 5, TradingView is another popular platform that supports automated trading. TradingView is a web-based charting and analysis platform that offers a wide range of technical indicators, charting tools and other features for traders.

TradingView also has a built-in programming language called Pine Script, which allows traders to create custom indicators and strategies. Traders can use Pine Script to create custom indicators, strategies, and even backtest them on historical data. Once traders are satisfied with their strategy, they can also use Pine Script to automate their trades.

TradingView also allows traders to share their custom indicators and strategies with other traders on the platform, making it a great place to find and use other traders’ strategies.

Traders can also use TradingView’s built-in scripting language to automate their trades on various brokerage platforms through the use of TradingView’s webhooks and API.

A large and active community of traders on TradingView shares and discusses ideas and strategies. This is very useful to improve your knowledge and skills.

Advantages of Automated Forex Trading Software

Automated Forex trading systems have many advantages over manual trading.

For starters, mechanical trading strategies are sometimes difficult to follow because trading signals may not always come when you’re sitting at the charts.

Because of this, you can be tempted to take poor trades when you’re at the charts, resulting in losses and a downward spiral of bad trades and losses.

If you’re able to control your emotions, it means you’ll miss a lot of trades that you could have potentially taken.

Additionally, automated Forex trading lets your edge truly play out over time, since you won’t miss any opportunity to trade when using trading algorithms.

Forex trading robots also have the advantage of speed, where they can open and close trades very quickly, scalping tiny bits of profit here and there from market movements.

In reality, it’s very difficult to predict where the market will truly move, so some automated trading strategies capitalize on up and down movement and use a grid system(also called martingale) to cancel out the ups and downs and pocket some profits in between.

Disadvantages of Automated Forex Trading Software

Automated trading systems vary, so not all Forex robots are profitable. In fact, a large majority of Forex robots lose unless you spend a lot of time optimizing the many settings and fine-tuning the parameters.

Auto trading is far from easy, because there are no completely foolproof systems. Most trading systems require constant monitoring and tweaking, so newbie Forex traders may be at a disadvantage.

Experienced traders that understand how the market moves and anticipate ups and downs can utilize automated trading software correctly by tweaking parameters and getting the desired results.

Still, a Forex robot does not have the discretion of manual trading, so it can end up taking some trades that a manual trader would have the discretion of avoiding.

Some robots go into deep drawdowns just to close a trade for minimal profit. This may work on paper, but some events can cause such massive drawdowns that a bad trade can wipe out an account.

Finally, Forex robots are ripe scam material and there are numerous scam robots that are just repackaged versions of other robots.

In some cases, the robots do work, but they require a lot of testing and optimization that newbies(the target market of these robots) often don’t have the skills yet to do.

How to choose an Forex automated trading program?

Choosing a Forex trading robot can be a daunting task, as there are many options available on the market. However, by keeping a few key points in mind, traders can make a more informed decision when selecting a trading robot.

Drawdown

First and foremost, traders should consider the drawdown of a trading robot. Drawdown refers to the percentage of capital that is lost during a losing streak. A trading robot with a low drawdown is preferable, as it means that the robot is able to recover from losses more quickly.

Profitability

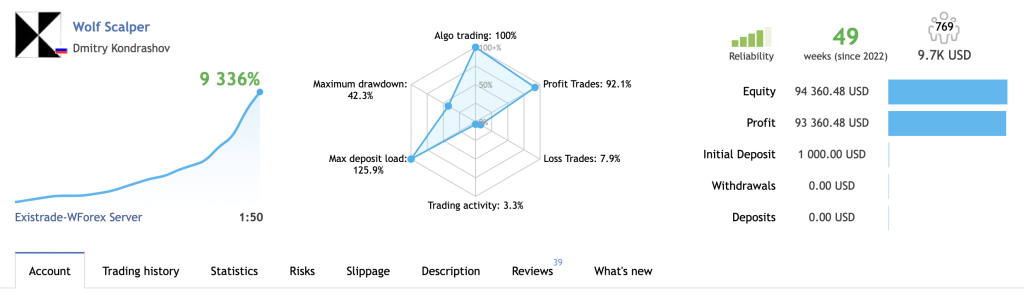

Profitability is another important factor to consider when choosing a trading robot. Traders should look at the historical performance of a trading robot to see how profitable it has been over time. It is important to keep in mind that past performance is not always indicative of future performance, but it can provide a general idea of how well a robot has performed in the past.

Trading Frequency

Trading frequency is also an important consideration, as some brokers may not allow high-frequency trading. Traders should ensure that the trading robot they choose is compatible with their broker’s trading restrictions.

Authenticated trading history results

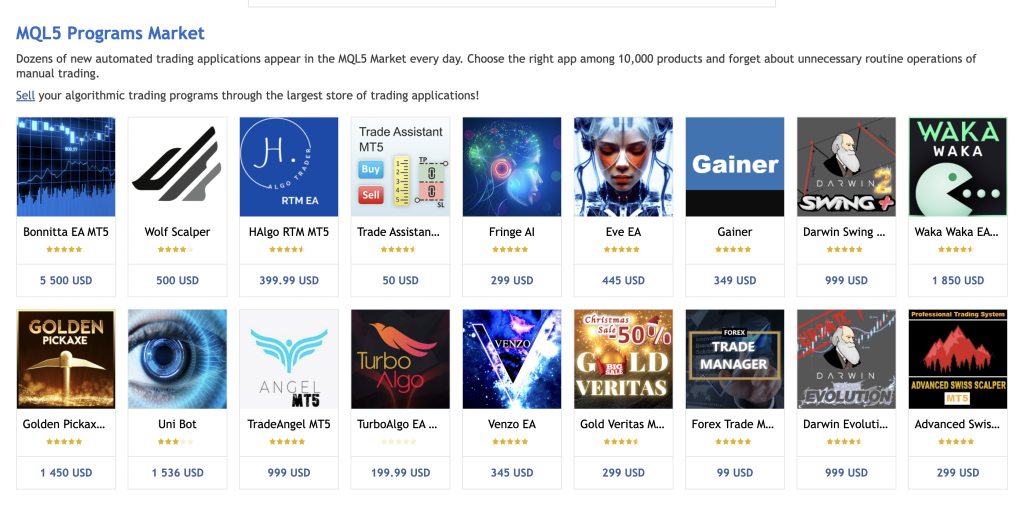

When evaluating a trading robot, traders should also look for verified live trading records on platforms like MQL5 or MyFxBook. These platforms provide traders with a way to verify the performance of a trading robot. Additionally, traders should also look for verified reviews from other traders who have used the robot.

However, traders should be aware that there are fake reviews on MQL5.com and indeed on TrustPilot too, which can be misleading. Traders should be wary of any trading robot that has a large number of fake reviews or a large number of reviews that are all positive.

The cost of a trading robot is also an important consideration. Good robots are usually moderately priced, not too expensive, but not too cheap. Traders should be wary of robots that are priced too cheaply, as they may not be as reliable as more expensive robots.

Finally, traders should also consider the community and support available for a trading robot. A trading robot with a large and active community of users will likely have more resources for troubleshooting and support. Additionally, a trading robot with a dedicated support team is more likely to be responsive to any issues that may arise.

Does Forex Auto Trading Work?

Automated forex trading works if you use a well-designed trading system and constantly monitor it. Setting reasonable expectations and using responsible risk management can result in consistent gains over time.

For example, Ryan from ResponsibleForexTrading.com almost exclusively uses algorithmic trading to generate 2-4% per month on his trading accounts.

2-4% may not seem much, but when you consider 2-4% of a $300,000 prop firm account, the numbers add up.

However, retail Forex traders still end up losing money because they don’t spend enough time testing the automated trading system and understanding how it works.

No auto trading bot is perfect, and test data is only accurate up to a certain degree. The only way to really see whether auto trading works is to test it in the live Forex market using a demo account.

The best automated trading software typically targets small but consistent gains. That’s because auto trading lacks the discretion of manual Forex traders(such as gauging support and resistance levels), so the only way to have an edge play out over time is to capitalize on opportunities quickly to ensure there are more profitable trades than losing ones.

It’s important to manage your expectations with any strategy.

How can I test automated forex trading software?

Before you deploy any expert advisor or copy trading signals on your live trading account, you MUST backtest the strategy to see if it’s profitable on historical data.

If it is, you can assume it will be moderately profitable in the live markets.

Historical data is not 100% indicative of live market conditions because it doesn’t factor in things like the speed at which ticks(changes in price) arrive, nor does it factor in slippage and execution.

If you’re looking at an EA from the MQL5.com store, you can find the EA in your MetaTrader 5 platform and get a demo that will only run in the strategy tester.

This way, you can play with the settings, find the best parameters, and buy the EA only when you’re confident of the results.

Social trading and Forex signals

If you’re not keen on testing and optimizing Forex robots, another option for automated Forex trading is using social trading or Forex signals.

For a small fee, traders provide entry and exit points. If you use MetaTrader, you can directly copy signals to your accounts, placing and closing trades with the signals you’ve subscribed to.

You can also copy trade using MyFXBook and other social trading platforms(listed below).

Social trading can be profitable, but you’re putting your entire trading account in the hands of a stranger.

If their trades suddenly start going downhill, you can lose your account.

Also, many copy trading systems usually go into deep drawdowns just to close a trade in profit. While this keeps the profitability high, it’s not sustainable in the long run, because a single bad trade can wipe out months of gains.

The best way to trade using signals is to ideally subscribe to a basket of signals and trade all of them using very low risk.

So instead of risking 1% per trade from a single source, subscribe to 4-5 signals with good track records and risk 0.2% on each one.

This way, your risk is diversified.

The Best Brokers For Automated Forex Trading

Etoro

toro is a user-friendly copy-trading platform that allows traders to replicate the trades of other investors across a wide range of instruments.

These include exchange-traded securities, forex, and popular cryptocurrencies. The platform was founded in 2007 and is regulated in multiple jurisdictions, making it a safe option for trading.

However, it should be noted that eToro’s fees are slightly higher than some of its competitors, despite recent reductions in spreads and the introduction of zero-dollar commissions for U.S. stock trading.

eToro’s main strength is its ability to combine self-directed trading and copy trading into one seamless experience.

Forex.com

Forex.com is a well-established copy-trading platform that offers a wide range of instruments for traders to follow and replicate. The platform is regulated in multiple jurisdictions and is considered to be a safe option for trading.

One of the strengths of Forex.com is its competitive fees and tight spreads. Additionally, the platform offers a range of educational resources and advanced trading tools to help traders improve their skills.

The downside is that it’s less social oriented than other platforms and doesn’t have a built-in social network. However, it’s a solid choice for traders looking for a reliable and cost-effective copy-trading experience.

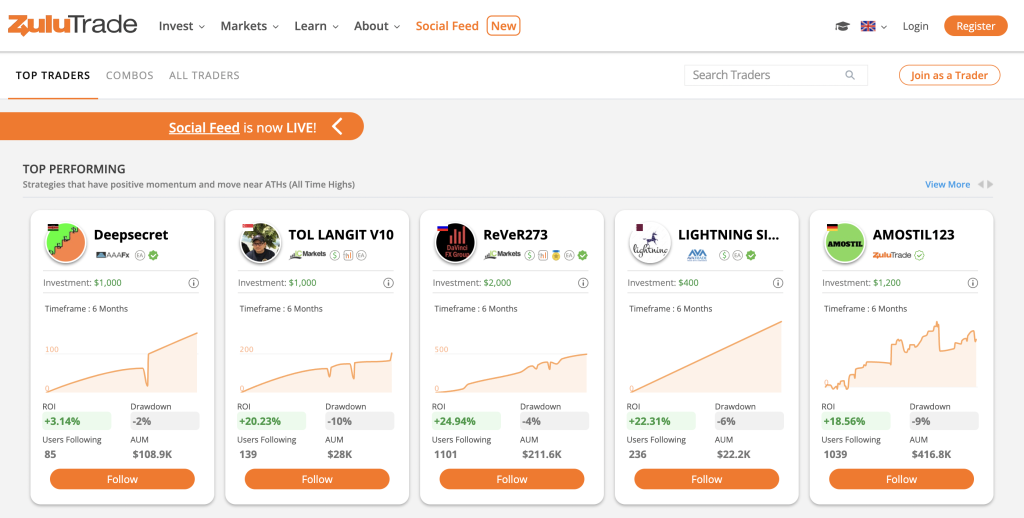

ZuluTrade

ZuluTrade is a popular copy-trading platform that allows traders to follow and replicate the trades of other traders. It offers a wide range of features, including a comprehensive social trading network, advanced risk management tools, and a user-friendly interface.

The platform is regulated in multiple jurisdictions and is considered to be a safe option for trading.

The platform’s social trading network and advanced risk management tools make it an attractive option for traders looking for a comprehensive copy-trading experience.

Making your own strategies

Another option for traders is to create their own Forex trading strategies. This can be a great way to customize a strategy to suit your specific needs and goals.

However, it is important to note that creating your own strategies requires coding background to write MQL4/5 or Pine Script, although both languages are not difficult to learn.

When creating your own strategies, you must think of mechanical rules you can implement.

These rules should be based on your own analysis and understanding of the market. Indicators are often easier to query than trying to figure out candlestick patterns.

If you don’t have a background in coding, you can also use drag and drop builders like iExpertAdvisor.com. These builders allow you to create your own strategies without the need to write code.

They provide an easy-to-use interface that allows you to set up your own rules and indicators. This can be a great option for traders who don’t have a background in coding but still want to create their own strategies.

Here are some resources you can check out to learn more about building your own automated trading systems:

Conclusion

Placing an automated forex trade can be much more foolproof than trying to trade manually. There are plenty of automated forex trading software options compatible with a wide variety of trading platforms that you can implement.

Just manage your expectations. These trading systems won’t make you an overnight millionaire, but using them properly can certainly yield a decent amount of returns.