The Forex market is HUGE, having a volume of nearly $6.6 trillion per day in 2019. The bulk of this $6.6 trillion flows through the 28 major Forex pairs that we’ve listed below.

Of these 28 pairs, 7 are considered Majors and the rest are Minors or Crosses.

Major Forex Pairs

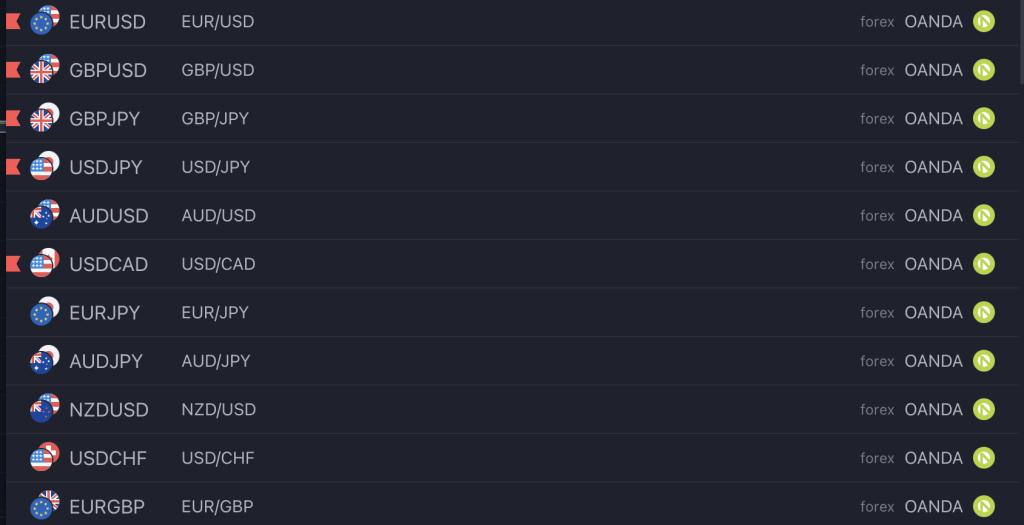

The 7 Major Forex pairs all include the US dollar:

- EUR/USD – this is the most-traded pair in the world and accounts for the bulk of the volume in the market

- GBP/USD – this pair is a little more volatile than EUR/USD

- USD/CHF – this pair is inversely correlated with the EUR/USD

- AUD/USD – also called the Aussie, AUD/USD tends to trend very nicely

- NZD/USD – also called the Kiwi, NZD/USD usually follows closely in AUD/USD’s footsteps

- USD/CAD – also called the Loonie

- USD/JPY – this pair has slightly more volatility than other pairs

Forex Majors and Minors (Crosses) List

Even though the bulk of the trading volume is in the 7 Majors, most brokers offer at least 28 pairs that you can trade. The minors don’t have quite as much trading volume, but they’re still VERY liquid, and they also tend to be more volatile than the Majors.

- EUR/GBP

- EUR/CHF

- EUR/CAD

- EUR/AUD

- EUR/JPY

- EUR/NZD

- GBP/AUD

- GBP/CHF

- GBP/CAD

- GBP/NZD

- GBP/JPY

- AUD/JPY

- AUD/CAD

- AUD/NZD

- AUD/CHF

- NZD/JPY

- NZD/CAD

- NZD/CHF

- CAD/JPY

- CAD/CHF

Forex Exotic Pairs

- USD/HKD

- USD/SGD

- USD/ZAR

- USD/THB

- USD/MXN

- USD/DKK

- USD/SEK

- USD/NOK

- USD/INR

- GBP/INR

Which Forex Pairs Should You Trade?

The most popular pairs to trade are the Majors, as they have the most volume and liquidity.

Pairs like the EUR/USD and USD/CHF are slow-and-steady, often taking half an hour or more to move 10 pips.

Pairs like the GBP/JPY and AUD/JPY are very fast and volatile, moving 10-15 pips in a matter of minutes.

Pairs with the USD tend to move slower, and pairs with JPY tend to move faster and with bigger moves.

The GBP crosses also move very fast, but they often have higher spreads.

Learn which pairs to trade during the Asian session

How many pairs should you trade?

The number of Forex pairs you should trade depends greatly on your trading style.

Swing traders don’t need to constantly monitor the charts and instead will probably look at the 4 hour and daily charts for their analysis.

So if you’re a swing trader, you can easily cycle through 28 charts every day to see how your setups are progressing.

Day traders have to monitor the charts a lot more to find their setups, and chances are, if a day trader is looking at too many charts, they’ll probably miss a setup here or there.

As a day trader, you’re best off looking at just 2-3 pairs at the most. This way, you can learn the ins and outs of those pairs, understand how and when they move, and use that to really capitalize on your entries and exits for maximum profitability.

Conclusion

The Major Forex pairs have more than enough variety and volume for any trader to easily catch some pips off of every day.

Remember, the key to success in the Forex market is consistency and patience!